indiana estate tax id number

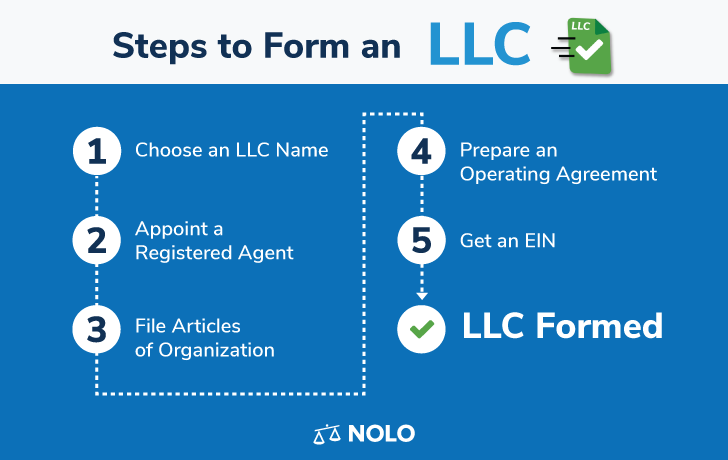

After applying for your EIN you can apply online for your Indiana Registered Retail Merchant Certificate. Estate Tax Legal 317-232-2154 Fiduciary Income Tax Customer Service-Processing 317-232-2067.

What The Numbers Mean In A Federal Tax Id Ein

December 27 2010 0231 AM.

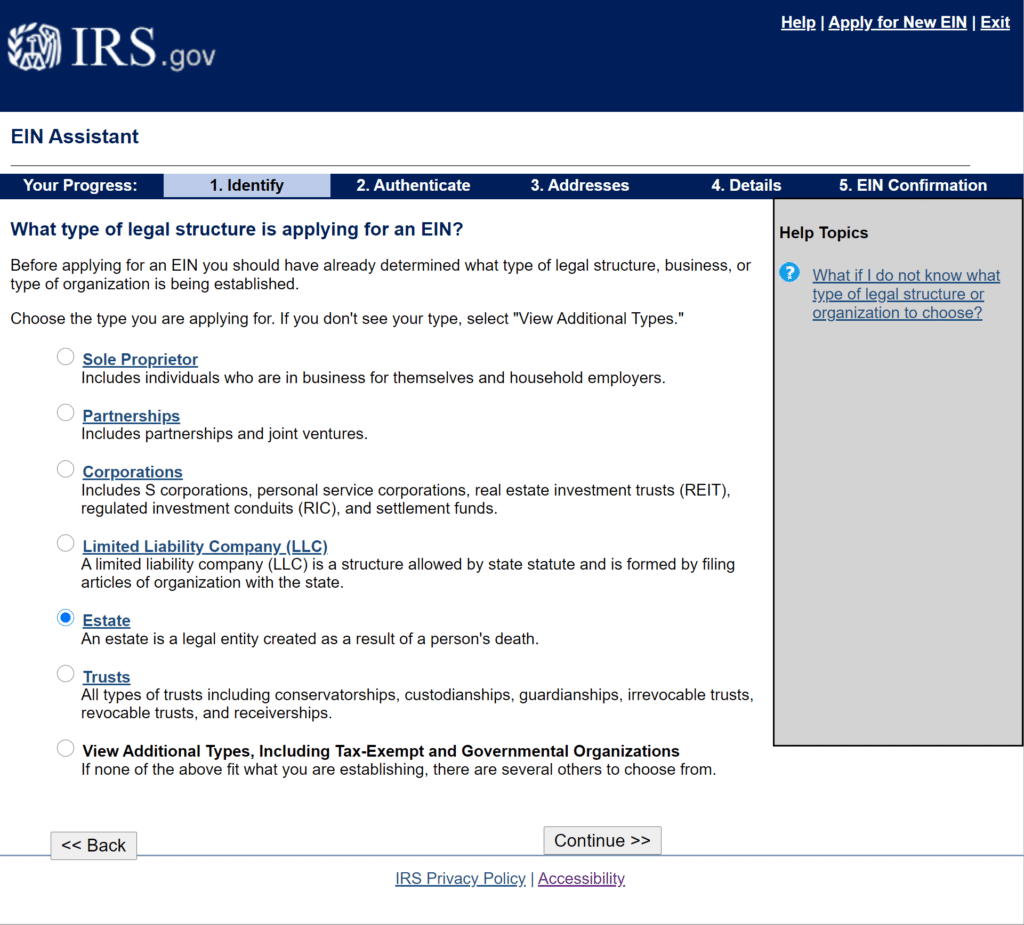

. Register online with INBiz. Simply visit GovDocFiling and enter your information. Select your entity type below and fill out the EIN Online Application form in order to.

Before you file an estate income tax return you need a tax identification number for the estate. Indiana Tax Identification Number. Indiana Tax Identification Number You can find your Tax Identification Number on any mail you have received from the Department of Revenue.

Click Register Now at the bottom of the page and follow the instructions. An Estate in common law is the net worth of a person at any point in time. Youll receive your Tax Identification.

The exemption has portability for married couples meaning that with the right legal maneuvers a. Be sure to have one. Over the last few years Indiana Counties have been converting their property record systems to use the State of Indianas 18-digit parcel number.

Obtain your Tax ID in Indiana by selecting the appropriate entity or business type from the list below. Indiana Estate Tax Id Number. Fuel Tax - Diversion Number.

Once your application has been submitted our agents will begin on your. If youre unsure contact the. The person making the call must be.

Setting up your Indiana Tax ID can be easy. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. Indiana Tax Clearance - Click to Expand.

Estate Of Deceased Individual admin 2019-01-25T0959370000. Eastern Time Monday through Friday to obtain their EIN. Please direct all questions and form requests to the above agency.

Fill out the EIN. Specialists will review the information and file all of the paperwork for you. An estates tax id number is called an employer.

Every business selling tangible goods in Indiana will need a Registered Retail Merchant Certificate to buy goods at wholesale prices without paying sales tax and collect sales tax on goods sold. It saves time if you have the data you need on hand such as your companys official name start date physical address and phone number. International applicants may call 267-941-1099 not a toll-free number 6 am.

An estates tax identification number also called an employer identification. Home Indiana Estate Of Deceased Individual.

Llc Indiana How To Start An Llc In Indiana Truic

Using Gifting Between Spouses To Maximize Step Up In Basis

How To Obtain A Tax Id Number For An Estate With Pictures

Allen Auction Real Estate Facebook

What Is My Estate Planning Trust Identification Number And Why Do I Need An Employer Identification Number Ein Russo Law Group

How To Get An Estate Tax Id Number Retirement Watch

How To Obtain A Tax Id Number For An Estate With Pictures

How To Obtain A Tax Id Number For An Estate With Pictures

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Llc In Indiana How To Start An Llc In Indiana Nolo

City Of New Haven Tax Bills Search Pay

File 1941 Mid Year Tax Calendar For Indiana Dpla Dae89696f77e09c596eacc3c2f4a4be8 Page 1 Jpg Wikimedia Commons

How To Obtain A Tax Id Number For An Estate

How To Obtain A Tax Id Number For An Estate With Pictures

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

How To Obtain A Tax Id Number For An Estate With Pictures